Hi guys,

Hope you are well. I’m doing okay, Alhamdulillah.

I write this at about 2:08 pm on a cool Sunday afternoon, out of a workspace only a few minutes away from my place. The weather is not too chilly, not too warm - just how I like it.

I came into this weekend hoping to tick many boxes. As the day winds down, it is clear to me that some things will carry over - as usual. But Alhamdulillah, the most important boxes have been crossed and we live to fight another day.

Let’s dive in.

—————

A few weeks ago, I saw a graph shared by Nick Magguili (I think) highlighting the relative ability of a person to spend money over a lifetime.

It has been on my mind for the past few days, and it brings a very strong counter-argument to the way I would typically think about savings and investments. I just spent several minutes scouring the internet for it, but I can’t seem to find it. So let’s think through it together.

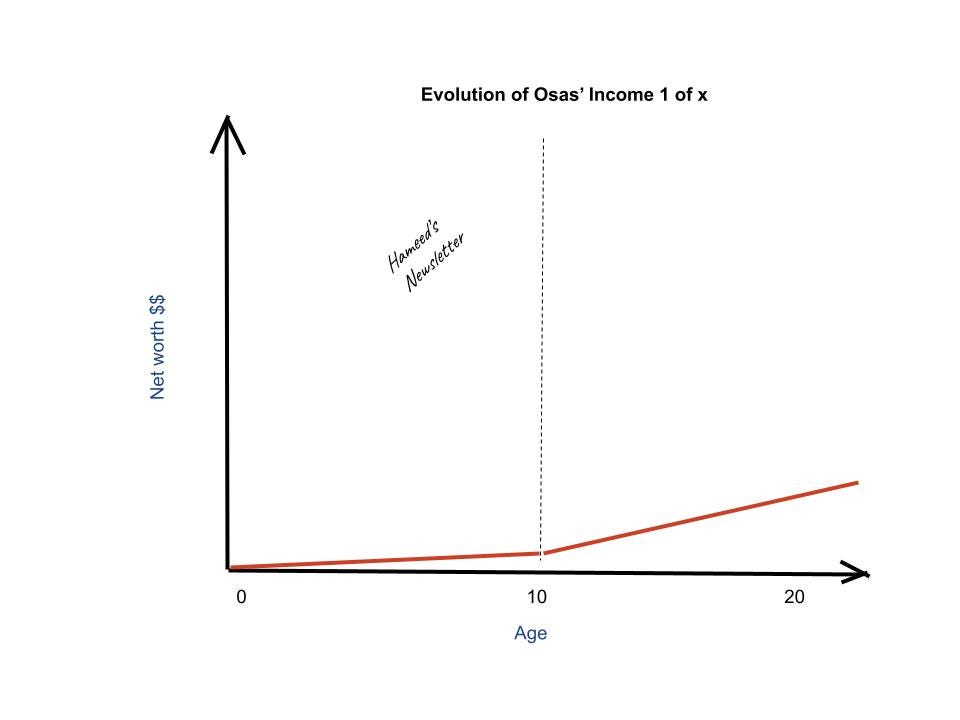

Let us assume for a second that Osas is a high-potential young person who cares deeply about financial independence. He has a good job in an exciting industry and hopes to spend the next few decades doing super interesting work and getting very well paid for it. If we tried to draw a graph of the evolution of Osas’s income over a lifetime, it would look like this.

In the first decade of Osas’s life, he basically earns nothing. Over the years, a few uncles, aunties, and family friends gave him cash gifts for ‘being a good boy’, which his Mum diligently saves up. As they start becoming significant, she opens a children’s savings account for him.

At about age 10, Osas is shipped to secondary school, where he begins to make his own money for the first time. Not only does he earn actual pocket money from home, but he also begins to get even more gifts from his extended family and parents’ friends, again for being a ‘good boy’. In university, this trend multiplies. He earns about 3x of his pocket money from secondary school and becomes a part-time photographer as well, occasionally making very good money.

** side note: This fictional story assumes that Osas:

follows a conventional career, the step-by-step approach to economic security.

cares quite a bit about preserving his income and does not spend all of it as it comes, otherwise, his net worth would have been constant over time.

is fortunate enough to have his income over time consistently go up, which really is not the way life works.

Anyhoo, Osas enters his twenties - the exciting, independent twenties. Fortunately, he gets a great job immediately after university, and life is good. He earns much more than he did as a student, and can now afford to do some of the things he could only dream about a few years ago.

But while he can buy the gadgets he wants to, eat at quite a few nice places, and even pay for vacations once in a while, he looks at his mentors and bosses in the workplace, who can afford much more. Houses, cars, and all the good stuff.

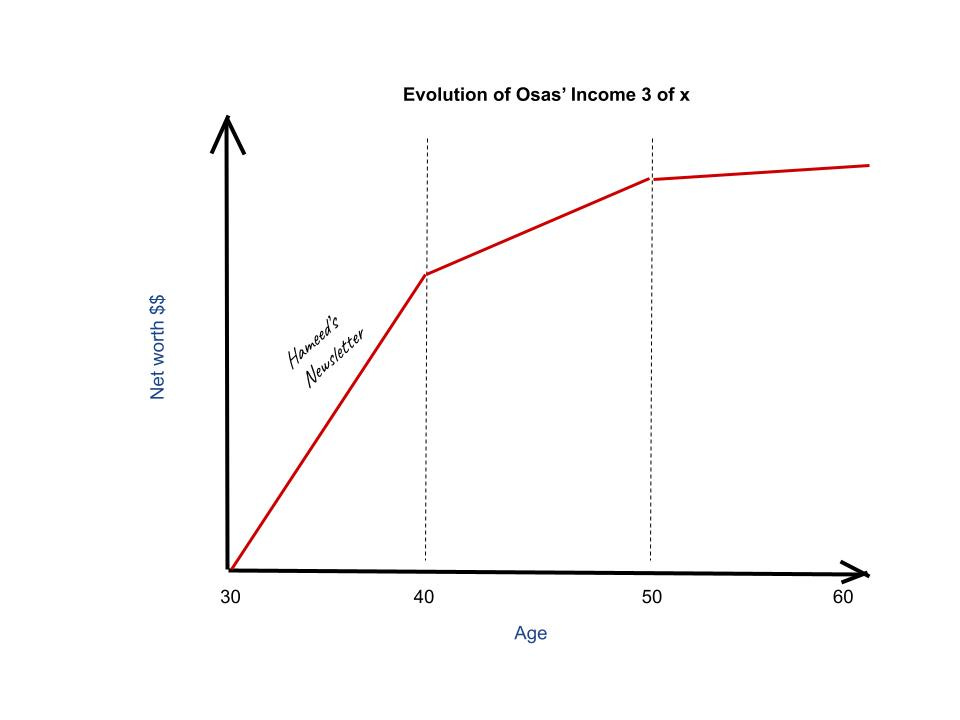

After many years of dedication, upskilling, job x location hopping, and whatever else, he enters his thirties. Oh, what a time. He begins to develop a solid reputation in his industry and receives the acclaim and economic security that comes with that. By 40, he is a Principal Software Engineer or Associate Partner or Head of Department or Consultant Ophthalmologist. You know what I mean.

If Osas is fortunate, life becomes even better from 40 to 50. While the difference is nowhere near as crazy as the income jumps from his twenties and thirties, he receives even more fruits for his labor. As he becomes among the older people in the workplace, he begins to attain some of the positions he has spent his life chasing.

From Principal Software Engineer to Chief Software Architect. Associate Partner to Partner. Head of Department to General Manager. Consultant Ophthalmologist to Director of Clinical Operations. All the good stuff.

If Osas has the talent, reputation, and network to deliver at these levels, then he gets the opportunity to maintain them in his fifties. He might even be fortunate enough to get nominal increases in title and compensation e.g. Partner to Senior Partner, General Manager to Vice President, Director of Clinical Operations to Medical Director, but these will not change his life. He is unlikely to change cars, move houses, or change his children’s schools at this stage. In fact, the difference in his lifestyle is barely noticeable.

At 60, the game is up.

For the vast majority of people, it’s all downhill from there from a net worth / income perspective. Osas retires - a lavish retirement to celebrate his service to the industry - and begins to draw from his pension.

While he still has tons of investments to live off for the rest of his life, he slowly realizes that the pot is unlikely to ever get bigger. Not in this lifetime at least.

Pause. Many people hate the concept of death. Ugh.

‘Why even go there man?’

Chill. I’m going somewhere.

The point Nick Magguili (or whoever it is I no longer remember) was trying to make was that while the average person’s net worth / income goes up from their twenties to sixties, their ability to spend that income does the opposite.

First, is the red-line graph of Osas’s income from 20 to 60.

If we were to introduce a blue line of Osas’s ability to spend his money over time, then that graph might look slightly different. By the ability to spend money, I mean Osas’s ability to have new experiences e.g. going mountain climbing, skydiving, moving to a new city, etc.

In his twenties, Osas is in his peak enjoyment stage.

Invite him for a trip to Abu Dhabi? Hell yeah.

Go on a hike through a cave in Scotland? Vamoss!

In his thirties, that enjoyment begins to dip. There are probably more serious things to think about, like the cost of building a house, getting married, and bringing children into the world. While the money is more abundant, his ability to spend it on enjoyment has taken a hit.

In his forties, things are quite similar - he has quite a bit more income, but his financial commitments are not allowing him to be great. While he has paid off the house, he is now saving for his kids’ university education in the US.

His priorities have changed. Who even has the time for things like skydiving anyway?

And in his fifties, there is a huge drop-off. He is anticipating retirement, and every extra penny he has is going to ‘responsible’ causes, like investments that will bring cashflow in his 60s and 70s, and ‘respectable’ weddings for his three daughters. Plus, he now has some small health challenges - hypertension, back pain, etc. The days of cave hiking are behind him.

Ati beebe lo.

The vast majority of you that read this newsletter are in your twenties, right at that stage where you’ve started to earn some financial independence, but it doesn’t quite feel enough. And maybe you have a plan to actively save and invest for now, at least until the time you make enough $$ to bamba and chill with the big boys. 😂

The aim of today’s post is to remind you that you are also at the peak of your enjoyment phase. And for as long as your ‘ability to spend money’ is high, it is in your interest to enjoy it.

So save. Invest. Buy assets.

But buy experiences too.

** Jara content:

Ibn Umar reported: The Prophet, peace, and blessings be upon him, said,

“The most beloved people to Allah are those who are most beneficial to people. The most beloved deed to Allah is to make a Muslim happy, or to remove one of his troubles, or to forgive his debt, or to feed his hunger. That I walk with a brother regarding a need is more beloved to me than that I seclude myself in this mosque in Medina for a month.

Whoever swallows his anger, then Allah will conceal his faults. Whoever suppresses his rage, even though he could fulfill his anger if he wished, then Allah will secure his heart on the Day of Resurrection. Whoever walks with his brother regarding a need until he secures it for him, then Allah Almighty will make his footing firm across the bridge on the day when the footings are shaken.”

Source: al-Muʻjam al-Awsaṭ 6/139

Grade: Sahih (authentic) according to Al-Albani

Have a great week. ✨

Haha, first 20+ years sounds so much like an Osas I know 👀.

Anyway, its this line for me:

"But buy experiences too."

Thank you.

This is awesome content. Well done 👍🏾